Is Your Mortgage Deal

Ending Soon?

Don’t pay £100s more than you need to. Or waste hours

comparing rates and chasing lenders.

Your FREE Mortgage Review, shows you what you could save, with clarity and confidence.

Top Rated Adviser (2022-2026) | Avg client savings £250–£800/m | FREE Mortgage Review

Why This Matters

When your fixed deal ends, you roll onto your lender’s SVR (much higher). On a £200k mortgage, moving from 3% to 7% = +£450 per month. Sticking with your bank, might be an easy option but could cost £1000s over the term.

SVR Shock

Your rate could jump overnight when your deals ends

£450 Monthly increase

Examples: £200k mortgage moving from 3% to 7%

Time Matters

Remortgaging isn’t instant - leave it too late and overpay

The smart move? Start 4–6 months before your deal ends, saving you time, money and stress!

The Smarter Way to Remortgage

With me on your side, remortgaging becomes simple, stress-free, and built around what’s best for you.

Tailored Support

Advice & Support tailored to your situation, giving you confidence at every step of your journey.

No Jargon

Clear, straight answers with no jargon and no confusion. Enabling you to make an informed decison.

Whole Market Access

Access to the whole mortgage market — not just one bank. Compare hundereds of deals to find your perfect match.

Your Mortgage PA

I handle the application through to offer, paperwork and the lenders — so you don’t have to.

The Smarter Way to Remortgage

With me on your side, remortgaging becomes simple, stress-free, and built around what’s best for you.

Tailored Support

Advice & Support tailored to your situation, giving you confidence at every step of your journey.

No Jargon

Clear, straight answers with no jargon and no confusion. Enabling you to make an informed decison.

Whole Market Access

Access to the whole mortgage market — not just one bank. Compare hundereds of deals to find your perfect match.

Your Mortgage PA

I handle the application through to offer, paperwork and the lenders — so you don’t have to.

What Our Clients Say

Here’s what happens when you work with a dedicated mortgager adviser who truly cares about your outcome.

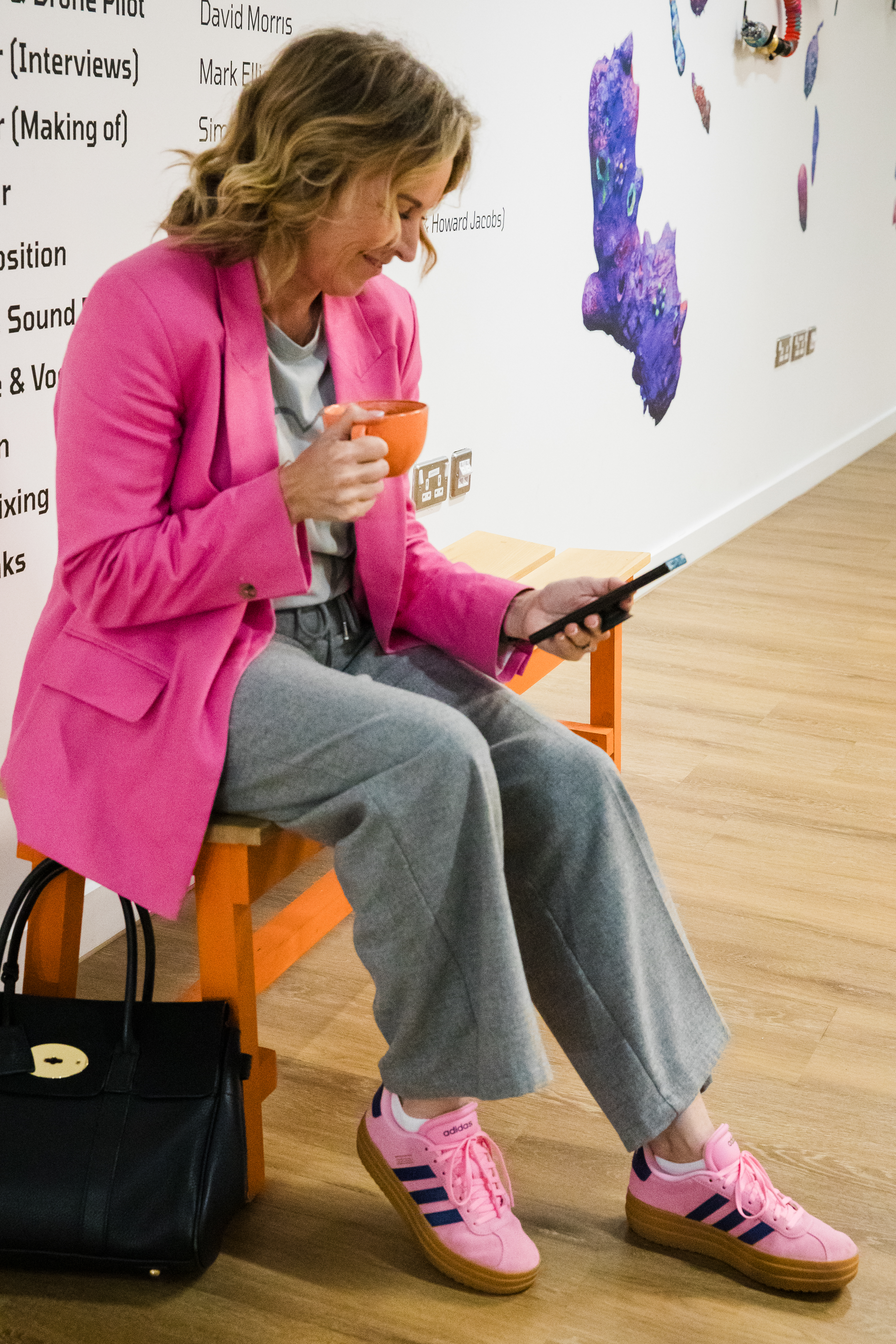

Meet Sarah - Your Mortgage PA

I'm not just a broker. I'm your dedicated mortgage partner who understands complex finances.

• Top Rated Adviser in the Telegraph & Financial Times (2022–2026)

• Landlord & business owner myself who understands complex finances

• I handle the application, paperwork and lenders - so you don’t have to

With me, you get more than mortgage advice — you get peace of mind, clarity, and results.

Meet Sarah - Your Mortgage PA

I'm not just a broker. I'm your dedicated mortgage partner who understands complex finances.

• Top Rated Adviser in the Telegraph & Financial Times (2022–2026)

• Landlord & business owner myself who understands complex finances

• I handle the application, paperwork and lenders - so you don’t have to

With me, you get more than mortgage advice — you get peace of mind, clarity, and results.

Avoid the 5 Biggest Remortgage Mistakes

Not quite ready to remortgage? Protect yourself from these remortgage mistakes before it’s too late. Stay ahead with this free guide.

Mistake #1

Leaving it too late and landing on higher rates overnight

Mistake #2

Falling for "cheap" headline rates that cost more long term

Mistake #3

Missing the 4–6 month window and overpaying for months

Plus More

Simple steps to stay mortgage-ready and save thousands

Your Questions Answered

Q: WHY DO I NEED TO ACT 6 MONTHS IN ADVANCE?

Remortgaging isn’t instant - Between the lender’s underwriting and the solicitor’s legal work, the process could take up to 12 weeks. Acting early means you lock in your next deal before your current one ends. Savings £100s or £1000s.

Q: WHAT IS A FREE MORTGAGE REVIEW?

A 30-minute review to see if you’re overpaying or could save money — no obligation, no fee.

Q: DO I NEED TO HAVE PAPERWORK READY?

Not for the review. Basic details are enough to start — I’ll guide you step by step.

Q: CAN YOU HELP IF I'M SELF EMPLOYED?

Yes. I help all types of homeowners. But if you are self-employed, I know exactly how to present your finances to lenders.

Q:WILL IT EFFECT MY CREDIT SCORE?

No. But our system will give you a free credit report.

Q:WHAT HAPPENS IF I DON'T SWITCH?

Nothing changes — but you might stay on an expensive rate. A quick check could save you £££s.

Q:WHAT IF I'M NOT READY YET?

Download my FREE guide. It explains the common mistakes and keeps you ahead of the game. I’ll keep in touch with tips until you’re ready.

Q: DO YOU CHARGE A BROKER'S FEE?

A fee may be charged for mortgage advice, the exact amount will depend on your circumstances.

Your home may be repossessed if you do not keep up repayments on your mortgage.

A fee may be charged for mortgage advice. The exact amount will depend on your circumstances.

IdentityFS is a trading style of Identity Financial Solutions Ltd,

which is an appointed representative of The Right Mortgage Limited which is authorized and regulated by the Financial Conduct Authority. Identity Financial Solutions Limited is a company registered in England and Wales Companies house number 06341454.

The registered office address is 6 George Street, Alderley Edge, Cheshire, SK9 7EJ.